For many businesses, the answer to both of these questions is yes. Break-even analysis can help determine those answers before you make any big decisions. For example, if the demand for your product is smaller than the number of units you’ll need to sell to breakeven, it may not be worth bringing the product to market at all.

Situation 2: Inflation-indexed bonds

When this happens, you’re spending a lot on employees that are not staying long-term in your company. To address this, consider training and promoting staff into positions with growth. It’s also important to screen and hire quality employees that would help the business fill fate definition supply chain thrive. Depending on your company, you might need to rent an office or warehouse to keep your business running. If you’re a new or small business, you’re especially vulnerable to the blow of rental costs. Try to find a practical space which can accommodate your needs.

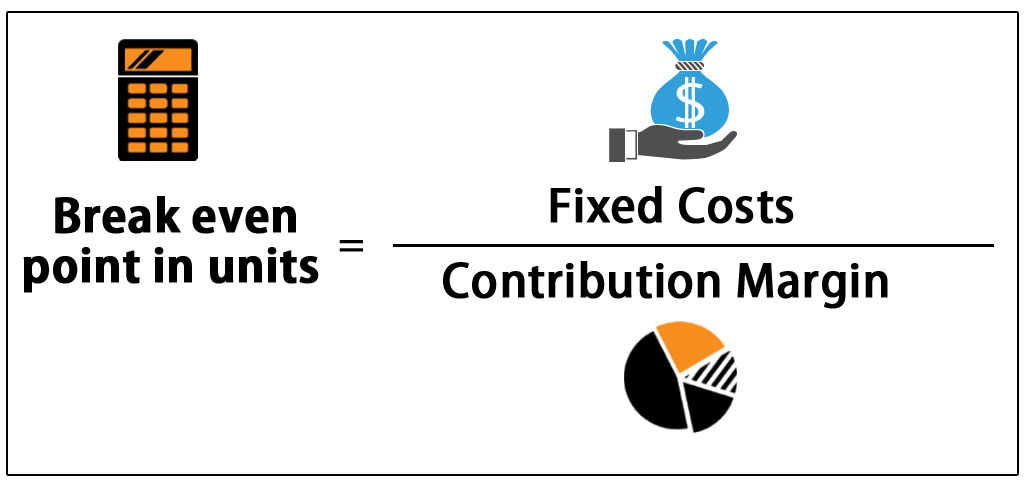

Break-Even Point in Units

The smaller your business, the more load the inventory has on your cost structure. Things such as retirement, benefit plans, and health care all add up and increase costs by 50%. This gets more expensive the more staff you employ, and the longer you employ certain personnel.

Break-Even Analysis: Formula and Calculation

Establish a clear budget for rent, up to how much you can reasonably afford. During the wake of the COVID-19 crisis, many companies have shifted to telecommuting or remote online work. This eliminated the need to rent office space for many industries. The break-even point is the number of units that you must sell in order to make a profit of zero. You can use this calculator to determine the number of units required to break even.

Issue Price Calculator

- It allows you to expand your network based on customers who have been satisfied with your service.

- But again, expect them to charge higher rates than traditional banks.

- Instead, you should enter the cost of an individual roll and a single hotdog.

- Use this calculator to determine the number of units required to breakeven plus the potential profit you could make on your anticipated sales volume.

The latter is a similar calculation, but it’s based around knowing how much you bring in over a certain period of time. It might be a good idea to come back to this break-even calculator after you actually start doing business. Often times you will find the need to adjust your costs and factor in things you overlooked before.

How to Calculate the Break-Even Point for a Service Business

On the basis of values entered by you, the calculator will provide you with the number of units you would require to reach a break-even point. Yes, you can use this calculator for any type of business, including manufacturing, retail, and services. If you entered the average price per trip and entered all your expenses as expenses per week, for you, the BEP is the number of trips you must make per week. Or perhaps you are an Uber driver who wants to know your break-even point.

Use our simple Break-Even Analysis calculator to determine the number of units you need to sell to cover your costs. Just enter your fixed costs, variable costs per unit, and sale price per unit. If you don’t reach the BPE within the desired timeframe, you’re in danger of incurring losses. To reduce BPE and recoup expenses sooner, it helps to cut costs on fixed and variable expenses. Things like looking for an affordable office or warehouse to rent will decrease BPE.

The fixed costs refer to necessary expenses such as rent or mortgage payments, utilities, marketing, research and development, etc. These are essential operational expenses that keep your business afloat even when you’re not producing goods. Meanwhile, variable costs are expenditures that increase when you raise your production. It includes the cost of raw materials and direct labor needed to produce a product. Generally, the higher the fixed and variable costs of a business, the higher the BPE. The result shows that Company A must produce and sell 500,000 units of its product to pay for their business’s fixed and variable costs.

Leave a Reply